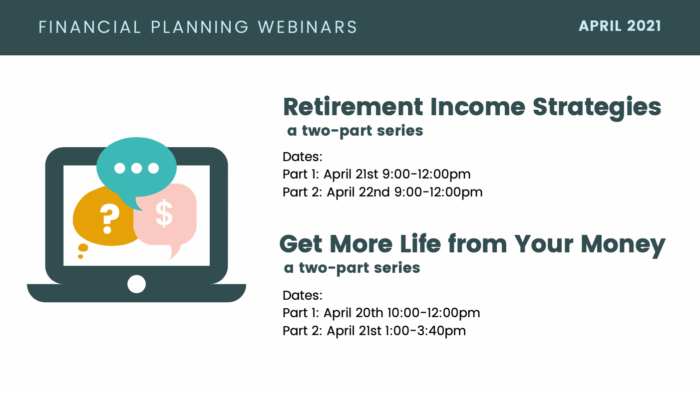

Retirement Income Strategies: A two-part webinar series

Joint us for this two-part webinar series that you can do from the comfort of your home. You don’t have to have your camera on, you don’t need anything other than an internet connection and computer to participate. There will be a lot of interaction and polls that will allow for input, and we also have live and private chats enabled so that you can ask questions and get the most out of this webinar.

This workshop is intended for anyone that is 0-15 years away from retirement. If you have longer until you retire, please see Get More Life from Your Money.

Part 1: April 21, 2021 9-12:00pm

Part 2: April 22, 2021 9-12:00pm

Sessions will cover:

- Pre & post-retirement cash flow management

- Debt and credit pre & post-retirement

- Determining retirement income

- Retirement income sources

- Retirement income stacking

Registration opens March 22, 2021.