Introducing Winton

What is it?

Stephanie Holmes-Winton has been facilitating our retirement and financial planning sessions for over three years. You now have access to Winton, an app developed by Stephanie and her team at CacheFlo. The Winton app provides essential spending advice and identifies how much cash flow the user could free up by following its recommendations. Winton also gives people full transparency and control over who has access to their financial information and can give advice.

IBEW 37 members have exclusive access to Winton because of our partnership with CacheFlo. This program is not available to the general public – so don’t miss out on taking advantage of this opportunity and sign up now!

How does it work?

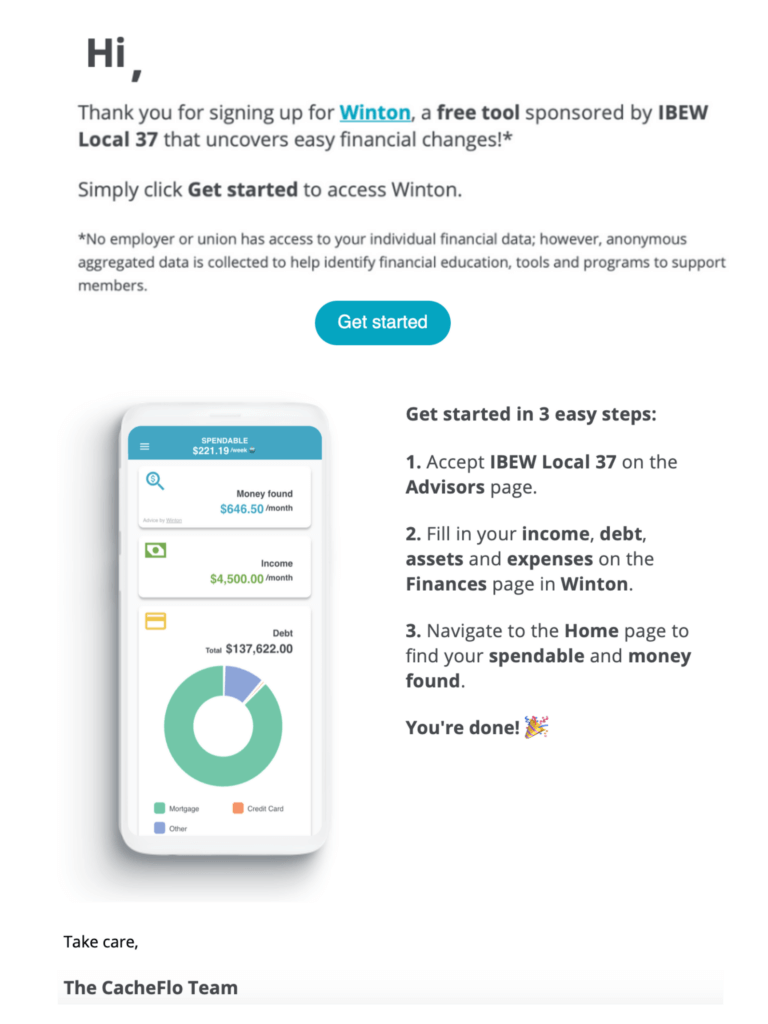

Simply sign up by making an account by clicking here or using the button at the bottom of the page. You will then receive an email with instructions on how to use the app – like the one below.

*Disclaimer: IBEW Local 37 does not have access to any personal data that members input into the Winton application. The only data that is available to IBEW Local 37 is aggregate financial health and usage data on the group, as a whole, to report on the efficacy of the program.

Available Now! Financial Capability Program

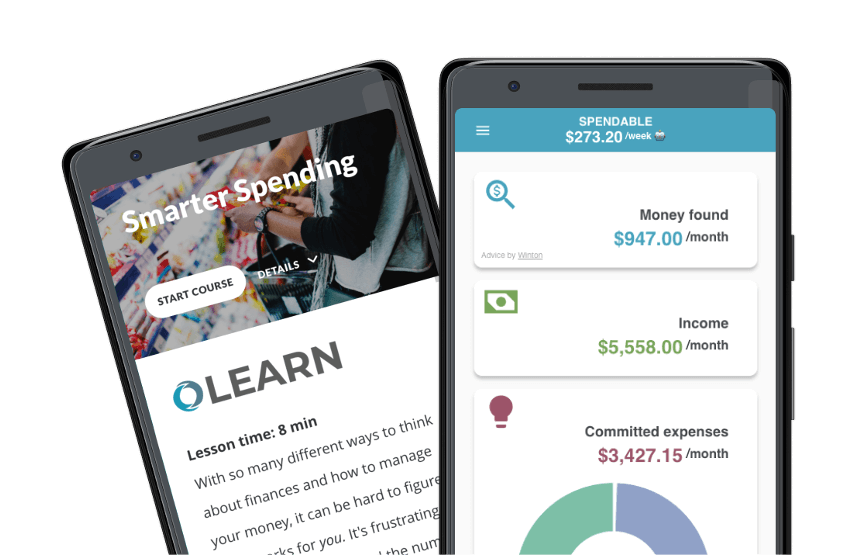

The Financial Capability Program (FCP) is designed to help you get more life from your money. Research shows that financial education doesn’t have a lasting impact if you don’t use it soon after you learn something new. The FCP combines short online lessons with the Winton app to help you make financial changes you can stick to right away.

The FCP does not focus on what you need to give up. So don’t worry. You can keep your morning coffee. Instead, you’ll learn ways to make sustainable changes. You can go through the lessons at your own pace from anywhere, on any device. Even if you only have a few minutes, you can pick up practical financial strategies that you can put to use immediately.

List of classes in order that are available through the Winton App:

Lesson 1: Budgeting Barriers (15 min)

Lesson 2: Mental Math (10 min)

Lesson 3: Smarter Spending (10 min)

Lesson 4: Meet Winton (20 min)

Lesson 5: Automating Accounts (5 min)

Lesson 6: Money Mindset (10 min)

Lesson 7: Goal Getting (10 min)

Lesson 8: Funding Fun (5 min)

Lesson 9: Safety Savings (5 min)

Lesson 10: Future Funds (5 min)

Lesson 11: Destroy Debt (5 min)

Lesson 12: Tips & Tricks (10 min)

Who can access it?

All members that pay into the TTF have access to the app – as well as their families.

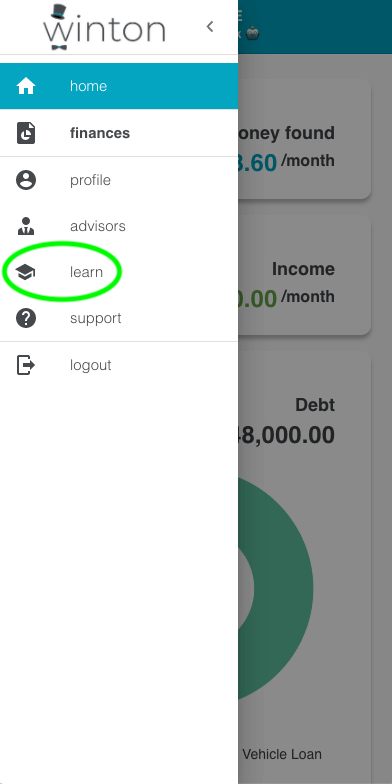

Access to eLearning will be available from your Winton app menu when it’s launched. So make sure you’ve got your Winton account set up, so you don’t miss out!